How Parents Can Help Pay For College

Every parent with a child going to college asks the same question: how am I going to pay for this education? Thankfully, there are a few different pathways available to help set aside money to cover tuition and other costs.

The most common options regarding how parents can help pay for college are listed below; consider each one carefully before choosing the most appropriate route for you.

Take a moment to learn how we can help your child with our year-round SAT prep and ACT prep courses today before they have to take either test.

How Parents Can Help Pay For College – Savings Plans

If you’re thinking ahead long-term, take advantage of a college savings plan.

If your child is getting ready for high school, or still in elementary school, opening up a college savings plan can help.

These accounts are great for setting aside money to hold for future tuition and housing payments. There’s a wide variety of available options you can use as early as possible.

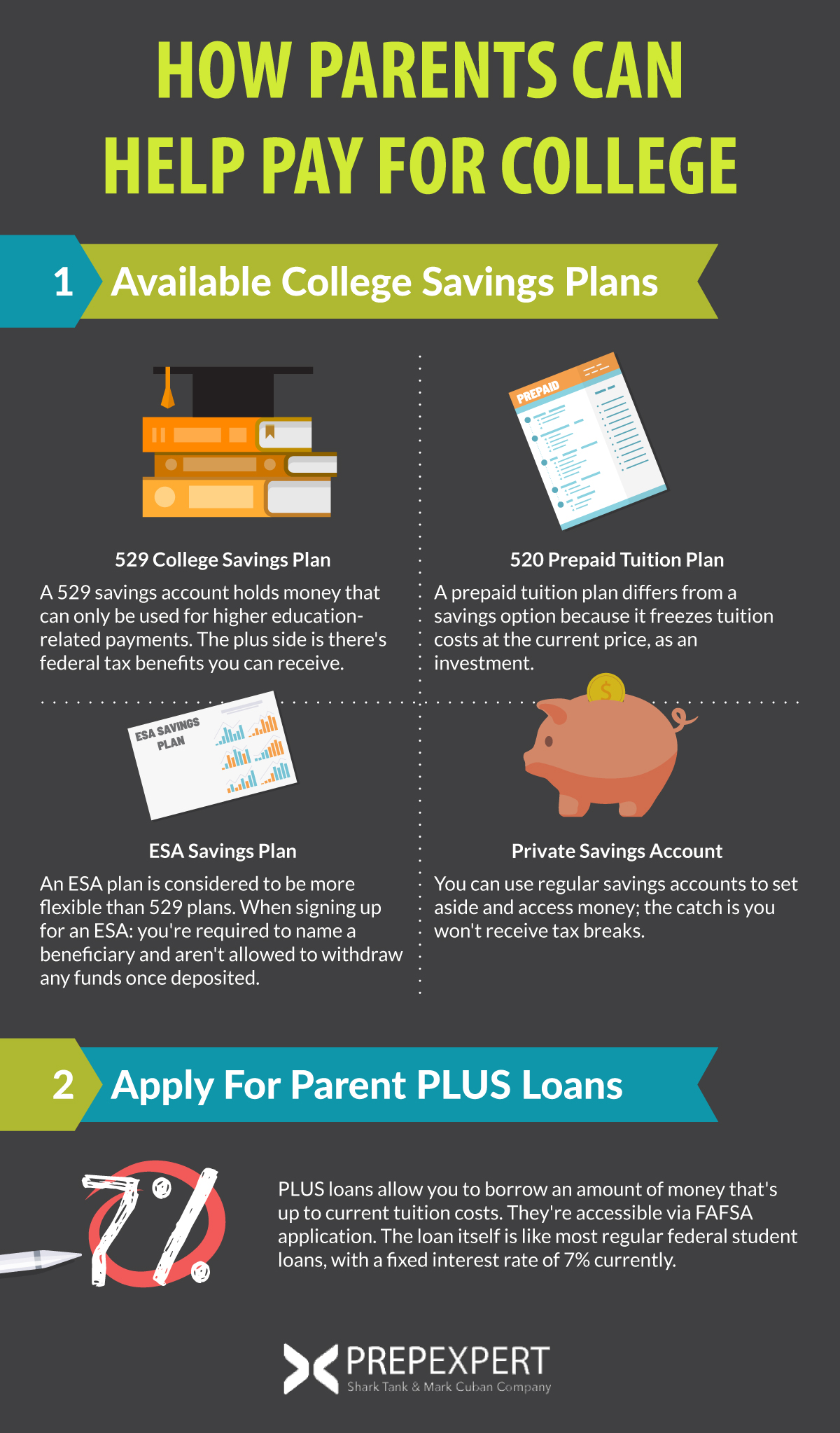

Available College Savings Plans

Listed below are the most common plans available to use:

- 529 College Savings Plan – This option is perhaps the most popular one parents choose. A 529 savings account holds money that can only be used for higher education-related payments. The plus side is that there’s a variety of federal tax benefits you can receive, as well as limited state ones too.

- 520 Prepaid Tuition Plan – A prepaid tuition plan differs from a savings option because it freezes tuition costs at the current price, as an investment. The problem though is, depending on changes in tuition market value, you could end up stashing away too little money later on.

- ESA Savings Plan – An ESA plan (Education Savings Account) is generally considered to be more flexible than either 529 plan. When signing up for an ESA: you’re required to name a beneficiary and aren’t allowed to withdraw any funds once deposited.

- Private Savings Account – You can always use regular savings accounts to set aside and access money easily; the catch is you won’t receive any tax breaks from it.

Apply For Parent PLUS Loans

Another common option parents often use are PLUS loans.

PLUS loans allow you to borrow an amount of money that’s up to current tuition costs. They’re accessible via FAFSA application. The loan itself is like most regular federal student loans, with a fixed interest rate of 7% currently.

However, the big difference is that your bill comes as soon as the loan funds are fully distributed. Also, you may not be able to qualify for forgiveness programs, unlike regular student loans.

There are ways to lower these loan payments, but be aware of these caveats before pursuing this option.

Cosign Private Student Loans

Most college students require loans; sometimes they’ll need a cosigner to secure them.

While federal aid can go a long way for college costs, sometimes it just isn’t enough money. In those cases, students often look to private loans to supplement the remaining bills. The problem is these loans often require an exhaustive credit history to qualify and solid credit score.

Most high school students don’t come near to having either qualification. This is where parents come in. Just remember that if you do cosign on a private loan, you’re now liable if your student is unable to repay it.

Make sure to have a serious conversation with him or her about what risk this loan creates for everyone, to ensure proper payment later on.

For more test strategy, college admissions, and scholarship application tips sign up for our FREE class happening right now!