In-State Vs Out-Of-State Tuition

The difference between paying a lot of money on college or not often depends on whether you’re paying an in-state or out-of-state tuition rate.

Take a minute to learn the basics of in-state vs out-of-state tuition, and how you can save money using the rules.

Take a minute to learn more about our various SAT prep and ACT prep courses today.

Why Does Out-Of-State Tuition Cost More?

The short answer is taxes.

Every person who owns property must pay property taxes. That money is then used by state governments as funding for public projects and organizations that benefit their constituencies like schools.

The major reason publicly funded schools have lower tuition for residents is because that tax money is used to make up the difference. If you want to attend an out-of-state school, then you pay for what that tax money won’t cover.

It’s simple as that. However, there are ways to enjoy that in-state discount, which we will discuss later.

Private Universities All Bets Are Off

It’s important to note that the in-state vs out-of-state tuition issue applies mainly to public universities.

Private universities don’t have this problem. Because they are private, these institutions do not rely on government funding whatsoever. They have to raise every dollar themselves from the student body.

Even if you are an in-state resident, if you are looking to attend a private university or college, then you’re paying the same rate as everyone else.

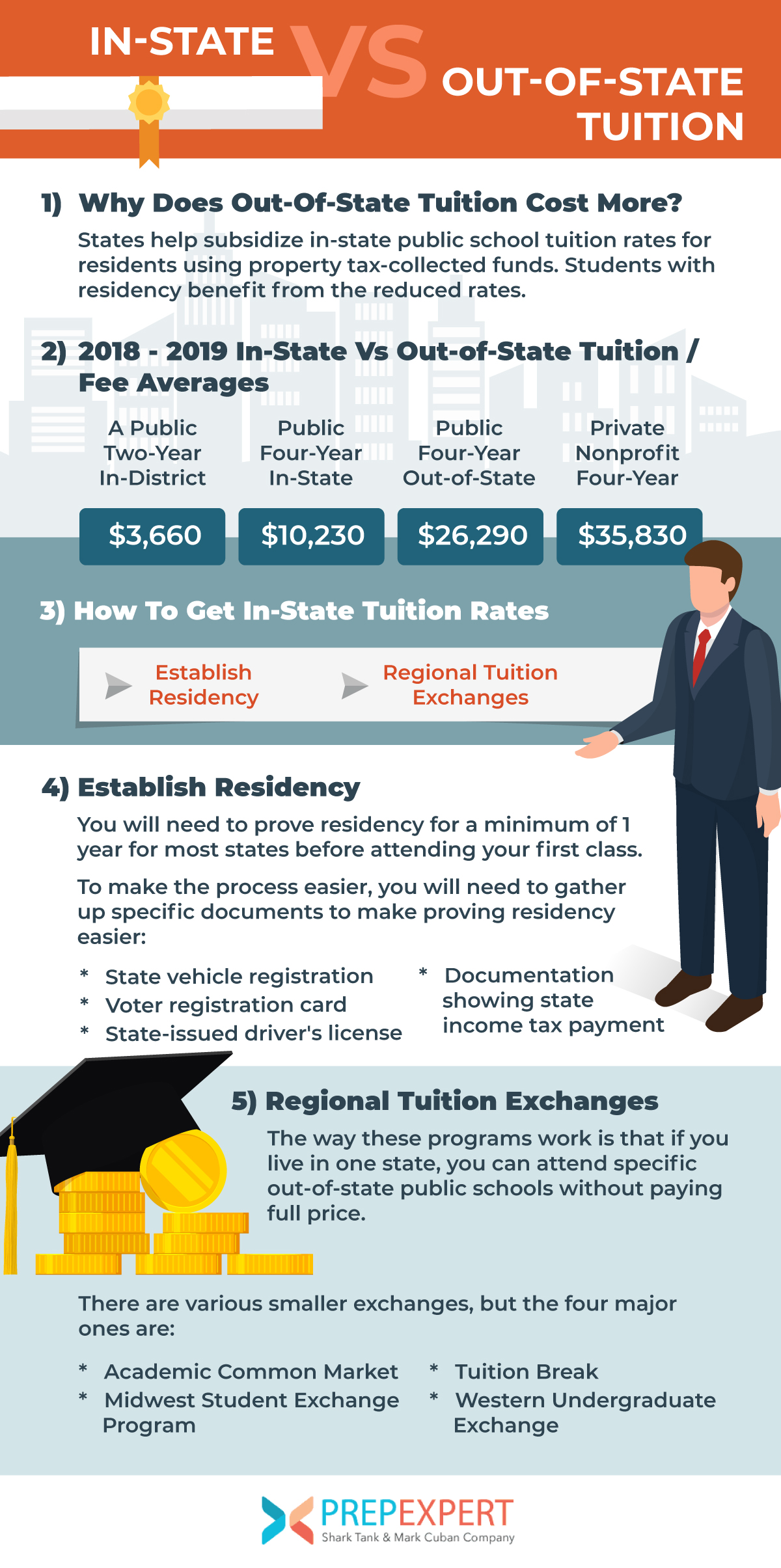

2018 – 2019 In-State Vs Out-of-State Tuition / Fee Averages

- A Public Two-Year In-District: $3,660

- Public Four-Year In-State: $10,230

- Public Four-Year Out-of-State: $26,290

- Private Nonprofit Four-Year: $35,830

So you might be asking yourself “is there any way that I can apply for in-state tuition rates if I’m coming from someplace else?” The answer is YES. You have two major options to turn to for help:

- Establish Residency

- Tuition Exchange Programs

Establish Residency

Be mindful of residency rules.

If you’re still a minor while attending freshman year, then at least one parent must be a state resident for an entire year to qualify. If you’re 18 or older, then you can establish residency yourself. Again, you have to complete one full year of residency before the first class of the semester.

Make sure to check the state you’re looking to attend first. The reason being that different states may have specific residency durations and age minimums to qualify for first.

To make the process easier, you will need to gather up specific documents to make proving residency easier:

- State vehicle registration

- Voter registration card

- State-issued driver’s license

- Documentation showing state income tax payment

Regional Tuition Exchanges

You can also save money without establishing residency first.

How? By taking advantage of the various “regional tuition discount programs” across the country. These programs are also known as tuition exchanges or reciprocity programs. 45 states participate in these programs to help students out.

The way these programs work is that if you live in one state, you can attend specific out-of-state public schools without paying full price. You won’t receive full in-state tuition states, but there is a helpful discount.

It’s important to note that these are agreements between states, but they don’t automatically apply to every school within each state. If you’re looking to use this option then look into the following: What exchange program your state is involved with, If your target school in that state is a part of the program.

There are various smaller exchanges, but the four major ones are:

- Academic Common Market

- Tuition Break

- Midwest Student Exchange Program

- Western Undergraduate Exchange

For more test strategy, college admissions, and scholarship application tips sign up for our FREE class happening right now!

Written by Dr. Shaan Patel MD MBA

Prep Expert Founder & CEO

Shark Tank Winner, Perfect SAT Scorer, Dermatologist, & #1 Bestselling AuthorMore from Dr. Shaan Patel MD MBA

The Student Loan Rules Just Changed—And Most Families Aren’t Ready

By Dr. Shaan Patel, CEO & Founder of Prep Expert® Student loans have always been complicated. But starting in…

Confidence Is the Hidden Score Booster No One Talks About

Most students think SAT® and ACT® success comes down to knowing more math formulas or grammar rules. That’s only half…

What Kind of SAT Score Gives You a Good Chance at a Scholarship in 2026?

As more colleges remain test optional, students often assume standardized test scores no longer matter for scholarships– but that’s a…