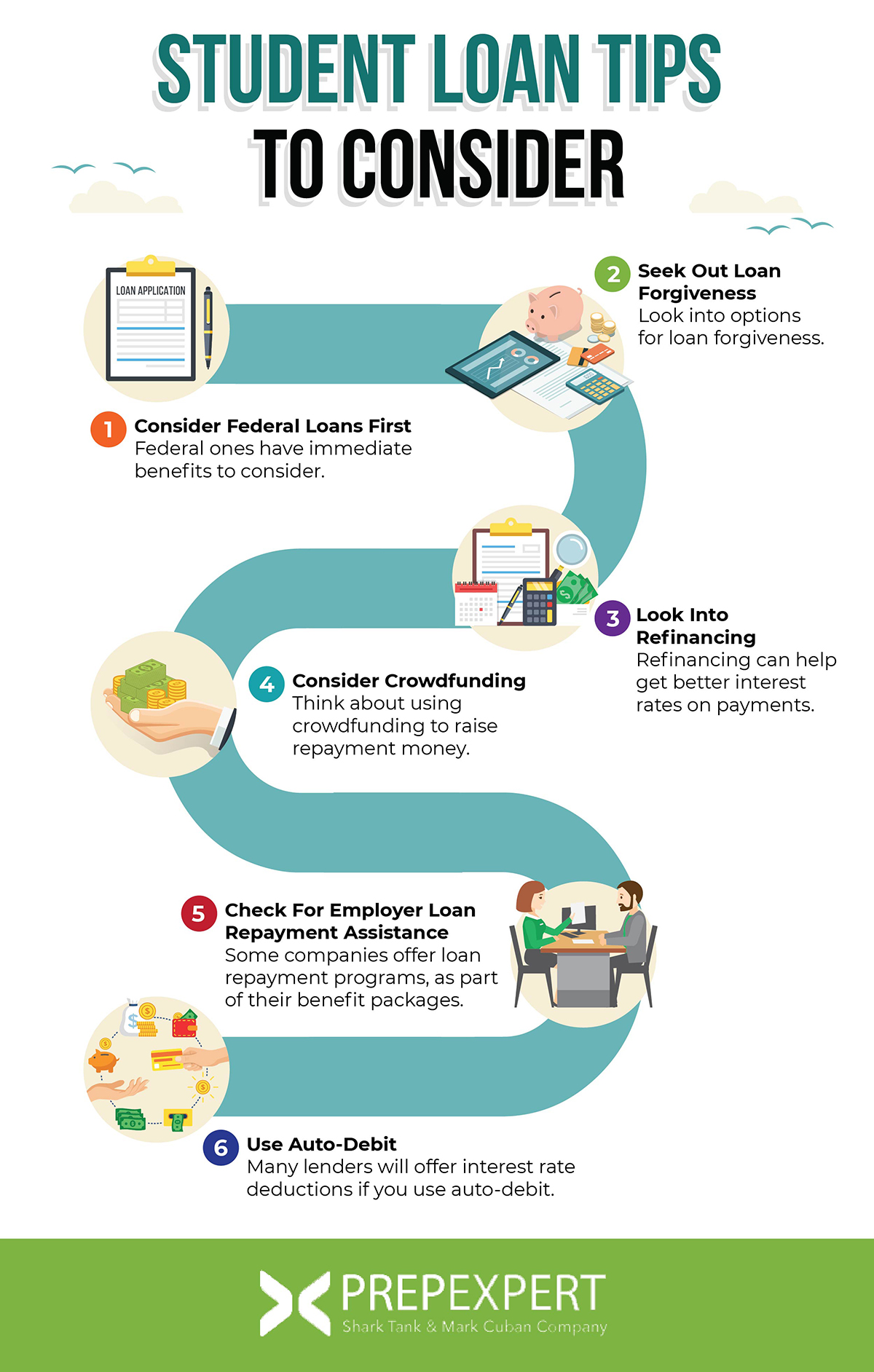

Student Loan Tips To Consider When Applying & Repaying

Many students are worried about taking on too much student loan debt while attending college. The good news is there are things you can do to make life easier while dealing with them.

Here are a number of student loan tips to consider when both applying for financial aid, and how to make repayment easier too.

Take a minute to see what we offer for SAT prep classes and ACT prep classes year-round.

Consider Federal Loans First

If you need to borrow student loans, then federal ones have immediate benefits to consider.

Federal student loans are good to look at first for the following reasons:

- Normally less expensive

- Easier qualification

- More repayment options

Moreover, federal loans often have specific protection programs. For example, with a federal loan, you can potentially defer payments if:

- You lose a job

- Go back to school

Seek Out Loan Forgiveness

Look into your options for loan forgiveness.

Another benefit of federal loans is the Federal Public Service Loan Forgiveness programs that can cancel direct loan debt under the following conditions:

- Make consistent payments for 10 years

- Full-time employment in a public service position while paying

While you’ll still have to pay a considerable amount of money, these programs can cancel a significant amount of debt. Go online to further research these programs.

Look Into Refinancing

A common way to save money is refinancing your loans.

Refinancing can help you get a better interest rate on your loan payments:

- Check out available programs online

- Look into potential rates they offer

You might be able to consolidate multiple loans into a single payment. If so, you can then adjust your budget to slowly start saving for long-term goals too.

Consider Crowdfunding

Think about using crowdfunding to help raise repayment money.

Many college graduates receive graduation gifts from their friends and families after graduation to help. Instead of receiving normal gifts, consider setting up a campaign via sites like:

- GoFundMe

- Zerobound

You can ask for donations to help cover your student debt. While it may not cover everything, you can at least solicit help from family who want to already celebrate your successful graduation.

Check For Employer Loan Repayment Assistance

It’s possible for your employer to help you pay down student debt.

Many large companies offer specific student loan repayment programs, as a part of their benefits packages. While not everyone does so, many large corporations have this option available for employees. The best thing to do? Simply ask your boss if anything is available and, if so, how to apply for help.

Use Auto-Debit

Many lenders will offer interest rate deductions if you use auto-debit.

To help incentivize new graduates, many loan lenders will offer interest rate reductions up to 0.50% if you utilize auto-debit. This service, which automatically deducts your loan payments from your bank account, can help save hundreds of dollars in the long term. Moreover, it can simplify the payment process so you aren’t late and penalized afterward.

For more test strategy, college admissions, and scholarship application tips sign up for our FREE class happening right now!

Written by Todd Marcus

More from Todd Marcus

Taking The ACT Junior Year

If you're ambitious and want to give yourself plenty of time for score improvement, then consider taking the ACT junior…

ACT 2020 Score Release Dates

Here then are the ACT 2020 score release dates to plan around, as well as, the different kinds of available…

How To Determine Your Average SAT Study Time

If you want a high score on the SAT, then you need to put in the hours. There's no way…